Get Your Free Credit Score

Canada Drives knows that understanding your credit score is crucial when buying a car. Use Borrowell to check your Equifax credit score for free and get tips on how to make improvements. Join over 3 million Canadians who have signed up for Borrowell!

What is Your Credit Score?

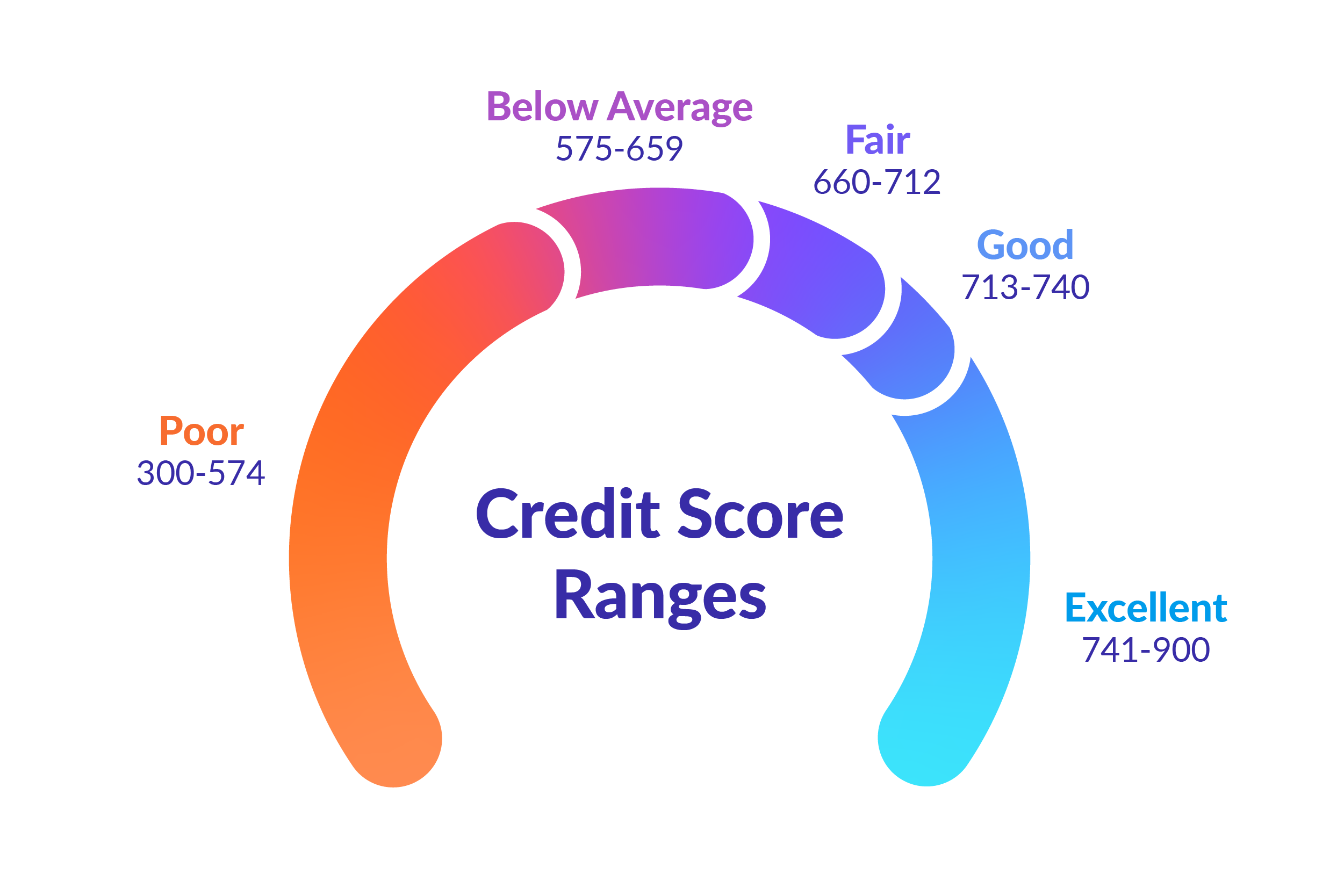

Your credit score is a number ranging from 300 to 900 that reflects your creditworthiness. Lenders assess your credit score to see how likely you are to make payments on time. Higher scores help you qualify for better interest rates on car loans, credit cards, mortgages, and more. A good credit score could potentially save you hundreds and even thousands of dollars on interest payments!

How Does Borrowell Work?

Free Credit Monitoring

Sign up in just 3 minutes for free access to your Equifax credit score and report.

Credit Education

The first in Canada, our AI-powered Credit Coach helps you understand your credit score and gives personalized tips that may help you improve it.

Product Recommendations

Compare financial products from over 50+ partners and get personalized recommendations based on your credit profile.

Why is Monitoring your Credit Score Important?

Lenders qualify based on your credit score

Your credit score is one of the main criteria for qualifying for credit cards, car loans, and even a mortgage. Because of this, understanding what your actual credit score looks like can help you when you’re ready to make your next big financial decision. With Borrowell, you can check your credit score for free and learn what financial products you’re likely to qualify for.

Loan payments improve your credit score

Making regular repayments can actually help you increase your credit score. Your credit history is a key factor of your credit score, so when you make on-time payments towards Refresh Financial Credit Building Loan or Secured Card, you’re building up your credit history in a positive way. This will help you improve your credit score and your financial health.

Higher scores qualify for more products

Building and monitoring your credit score will help you when you’re shopping around for your next credit card, car, or mortgage. With Borrowell, you'll receive personalized tips on how to improve your credit score. As your credit score improves, Borrowell can help you find credit cards, loans, and other financial products that can help you reach your next milestone.

Over 3 Million Canadians Trust Borrowell

Andrea B.

Google

I have been using Borrowell for over a year now and I am a happy customer. I get the real deal on my credit and good advice also!

Ashvin G.

Facebook

Excellent service. Recommend to understand your finance and banking accounts, debt control, loan utilization to build a good credit score for lending purpose.

Sam V.

Twitter

Just checked my credit score using Borrowell for FREE and without affecting my score! Gotta love Canadian startups.

Canada Drives is Excited to Partner with Borrowell

Canada Drives Wants to Help You Improve Your Financial Health

Canada Drives knows the key to managing your financial health is understanding your credit.

Thanks to this new partnership, Canada Drives customers can receive free credit monitoring, including their free credit score and access to Borrowell's financial product marketplace.